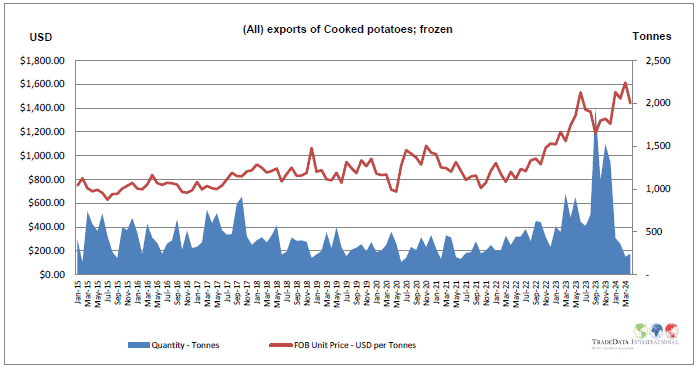

European Frozen Fry Exports to New Zealand

Source: World Trade Data – Exports of frozen fries from Belgium, France and the Netherlands

For the period ending April 2024:

- Export volume to New Zealand has decreased significantly in latest 3 months. This has to be good news for the NZ potato industry.

Exports of frozen fries to New Zealand from Belgium and the Netherlands

Other global insights:

- The previous wet weather in Europe has meant that growers planted late which coupled with a smaller season last year has pushed free-buy prices European processors have to pay to record prices, more than double the price of contracted potatoes.

- European processors are finding it harder to compete in Asian markets with the instability of shipping in the Red Sea.

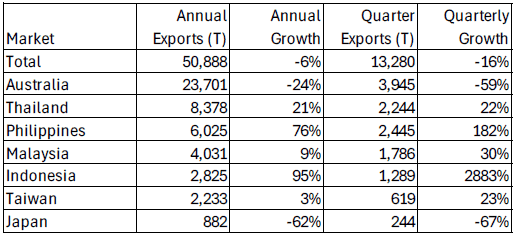

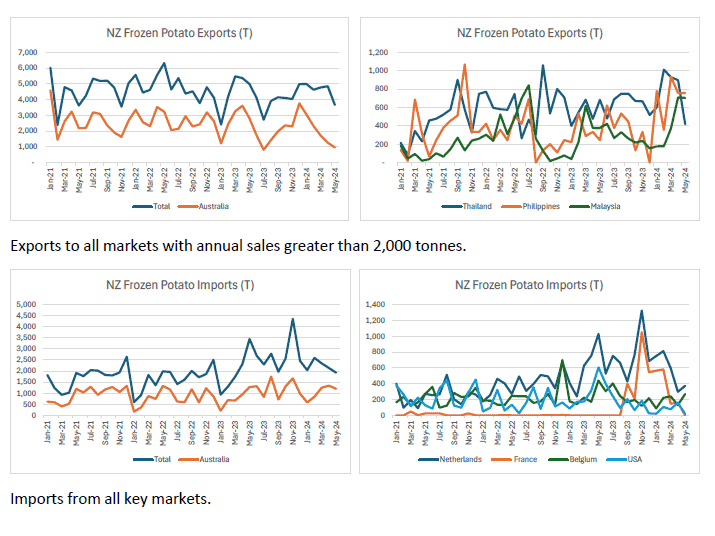

New Zealand Frozen Potato Exports and Imports

Source: New Zealand Statistics – All Frozen Potato Products to end May 2024

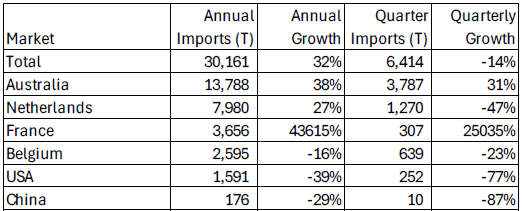

Imports

Total imports last 12 months 30,261 tonnes with annual growth 32%. Growth on quarter has slowed and is now down -14% versus same quarter year ago.

- Import growth remains high for Australia.

- France has quickly become the third largest supplier to New Zealand. However the

- volume of these imports appears to have slowed dramatically.

- A proportion of these imports from France is the New Zealand processing industry.

- Belgium as a supplier is in heavy decline but is more than made up by increased imports

- from France and the Netherlands.

- Encouragingly imports from China have continue to decline.

Exports

Overall export performance impacted by the reduction in exports to Australia.

- Sales to most Asian markets impress, particularly in the face of competition from USA,

India, China and Australia. - Sales to Japan are an issue with this market hotly contested all major processing nations

- it would seem as well as newly emerging China.

- Excellent performance from the NZ industry exporting to Thailand, Philippines,

- Indonesia, Malaysia and Taiwan.

- Summary of key export markets below.