By Glenys Christian & Gemma Carroll

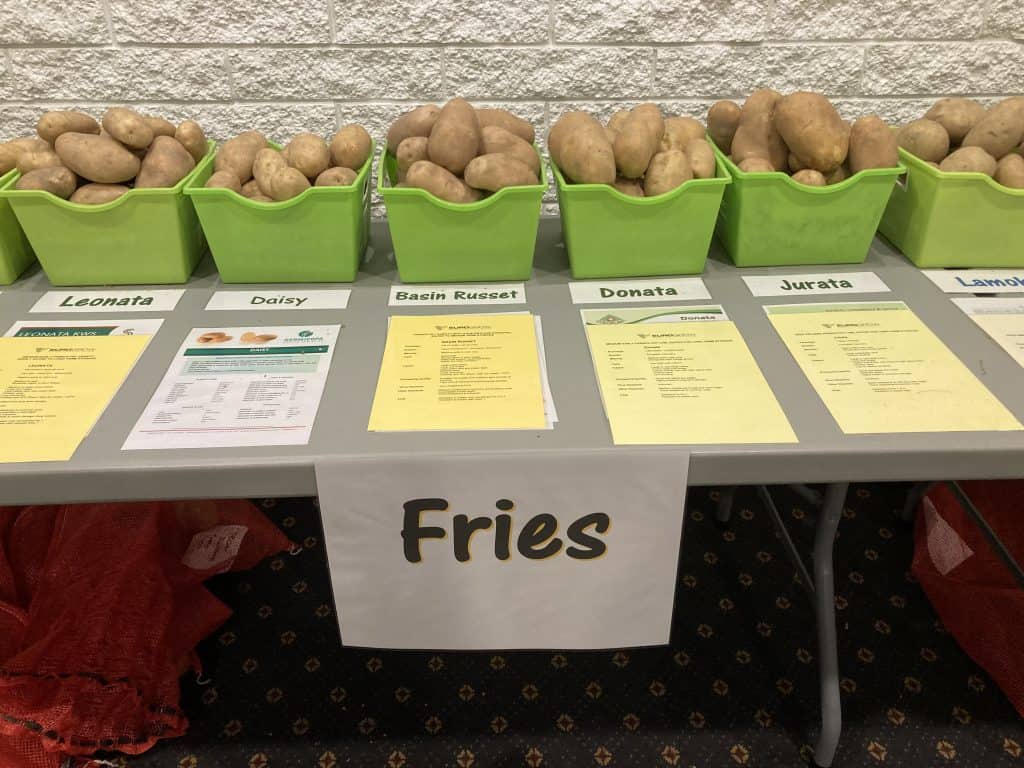

Varieties exhibit.

The bland house-brand offering of potatoes in supermarkets means consumers are getting confused, says Eurogrow general manager, Tony Hendrikse, at the recent Eurogrow Potato Seed Exhibition, held in Canterbury and Pukekohe.

There is less packaging highlighting the producer of the potatoes to which consumers had previously felt connected. Some point-of-sale material in supermarkets even appeared to come from Australia, showing a red-skinned, white-fleshed potato as best for roasting, which shoppers could not buy as there were no such potatoes for sale in New Zealand.

“It’s our job to turn that around,” he told Pukekohe growers attending the company’s North Island potato variety exhibition in late March.

“It’s not the consumers’ fault. We have got to supply what they are looking for. And that is a product that’s suitable for them, does what it says it will and when they eat it, they say, ‘Yum’.”

(The NZ Commerce Commission has recently undertaken a survey for food producers where these concerns could be raised. Growers are welcome to email their concerns whilst maintaining anonymity to znexrgfghqvrf@pbzpbz.tbig.am).

The main challenge in the seed market was keeping the pipeline of new potato varieties in balance with demand. Usually, the company will grow up to two to three tonnes of seed for a new variety, then if a particular sector likes one, they will be given more to grow to prove its worth. But that can mean considerable wastage as in some instances two thirds of new material is thrown out with a strike rate of one in seven or eight being usual. The domestic development programme for new varieties is under a lot of stress due to a lack of local potato breeders.

New varieties were quarantined in Scotland where there was a wait of two years, then they could be cleared in six months. That compared with an eight-year wait to get them into quarantine in this country.

After tissue culture and early generation production, trials were carried out where they were planted on growers’ properties, often right alongside the best performing varieties for comparison. Before harvest, the tops were evaluated for disease and vigour then there were three metre digs of the tubers which were assessed for yield, tuber size, skin finish and flesh and skin colour. Processing and cooking tests were carried out while family and friends were given the chance to sample the crisps and fries produced.

In the crisping varieties Levinata was the standout amongst trial lines under evaluation. It stood up well, had good leaf and produced the best trial yield of 63 tonnes a hectare in Matamata.

“It also cooks well out of long-term storage so there’s a lot of hope around it.”

It appeared to be a better performer than VR808 which came to New Zealand in 2008/09, showed phenomenally good storage of seven to eight months but yields were disappointing in the North Island.

Sorrentina and Madison had excellent dry matter content, but yields were “a bit limited”. Lamoka “needs to be wrapped in cottonwool” but yields well with good soil and irrigation,

With fries Tony said the industry was in a holding pattern due to the decrease in overseas tourists. Crop 111 was late bulking; total yield was OK but there were a lot of smalls. Eurogrow has entered a pre-commercialisation evaluation of this variety with Plant & Food Research.

Leonata was the most promising fry variety with the highest yields in Waikato trials and good storage. Basin Russet produced a large sized, cream to light yellow potato but the set was lower than ideal.

“On harder ground it sizes up to something we can use.”

It cooked OK and had 200-day storage. While Jurata sized up well early on it then “went to sleep”. Donata was extremely popular in Germany with high yields but was susceptible to powdery scab.

In the fresh category Agria popularity was a double-edged sword as some people thought all yellow-fleshed potatoes were Agria, and supermarkets wanted it all year round.

In the new varieties Jelly was deep rooting, needed low inputs and had up to 60 percent better yields than Agria in the Waikato. Everest’s yields compared with Nadine – “but it beats it hands down on taste”. There were many promising new lines with yellow flesh, excellent taste and differing end use suitability but packing and promoting these to give consumers a positive experience was key.

In the speciality area the value proposition was increasingly attractive with smaller volumes sold but at a premium price. So, there was a lot of interest in baby potatoes and novel lines such as those with red or purple flesh. Isabella was genuinely nice tasting and had taken over the market in Germany. Cerisa and Bellanita were longer “fingerling” potatoes also with excellent taste, while Lily Rose had novelty appeal with its red flesh.

There were 30 new potato varieties on show which Eurogrow said collectively cost a total of $250,000 to get to that point.

Asked about whether nitrogen inputs and outputs were evaluated he said there were strong signals that some of the deeper rooting varieties were more environmentally sustainable, although suitability for end use also needed to be considered.

ADDENDUM

Potatoes NZ in partnership with VR&I, Horticulture New Zealand and with funding from Ministry for Primary Industries, are in the first year of the Sustainable Vegetable Systems Project (SVS) which addresses the true nitrate leaching of potatoes and other vegetables whilst improving the modelling tools available to industry. This in combination with applied mitigation techniques will contribute to improved environmental outcomes.

SVS Project Manager Andrew Barber says “there is the possibility in the near future, of a concurrent PNZ project to look at nitrate mitigations including the potentially important varietal attributes of potatoes”.