Latest Potatoes NZ Industry Volumes & Values

by Gemma Carroll, Communications & Engagement Officer.

Chris Claridge, Potato New Zealand’s CEO, is pleased to see steady growth in potato volumes and values.

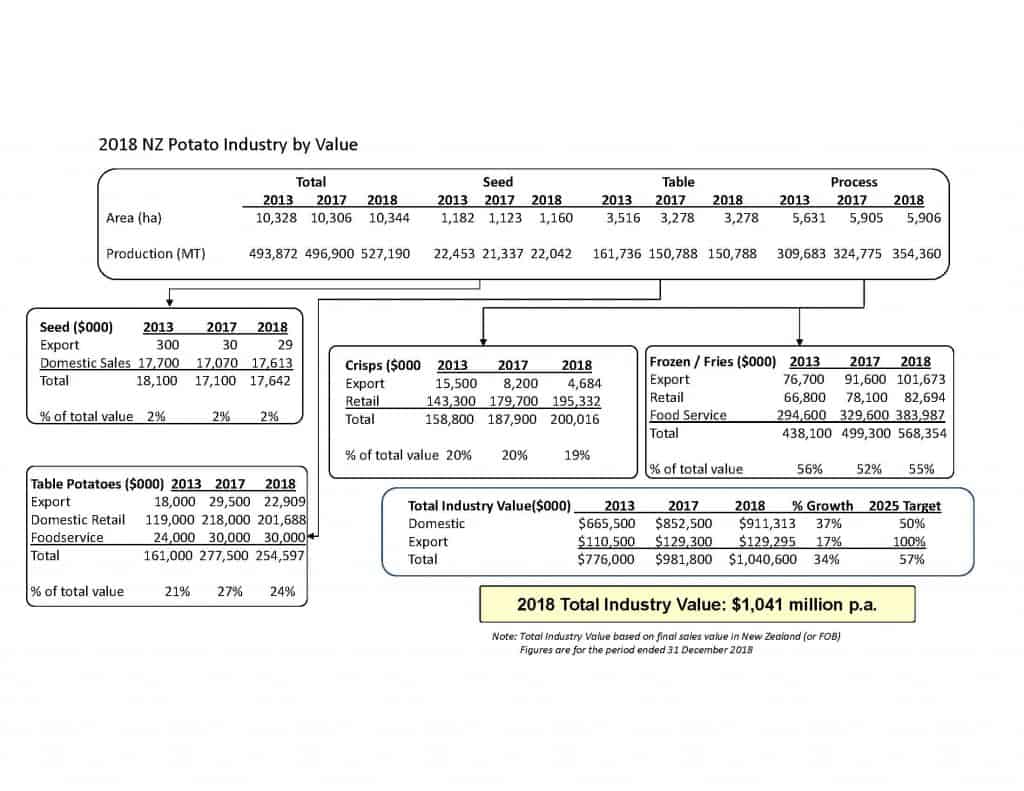

“The latest figures in from 2018 indicate we’re holding our own in exports and the value domestically has gone up. It’s a good report. However we would like to lift our export market.”

The industry is on target domestically, where we’ve achieved a 37% increase in values from 2013. Our strategic goal is to increase domestic market value 50% by 2025 and this looks achievable.

The export market is not quite where we’d like it to be for our 2025 goals – we’re currently at about half the annual rate of growth for export from where we need to be. The industry 2025 goal was to double exports – the questions at hand are; do we have enough land? And do our processing facilities have the capacity?

The reality is potatoes’ export value can achieve $30-40,000 per hectare, with less environmental footprint than other primary sectors. We need to make it as easy and sustainable as possible for farmers to grow potatoes.

We know our product group is the 3rd highest horticultural export and we need to protect and grow that NZ asset.

Key points

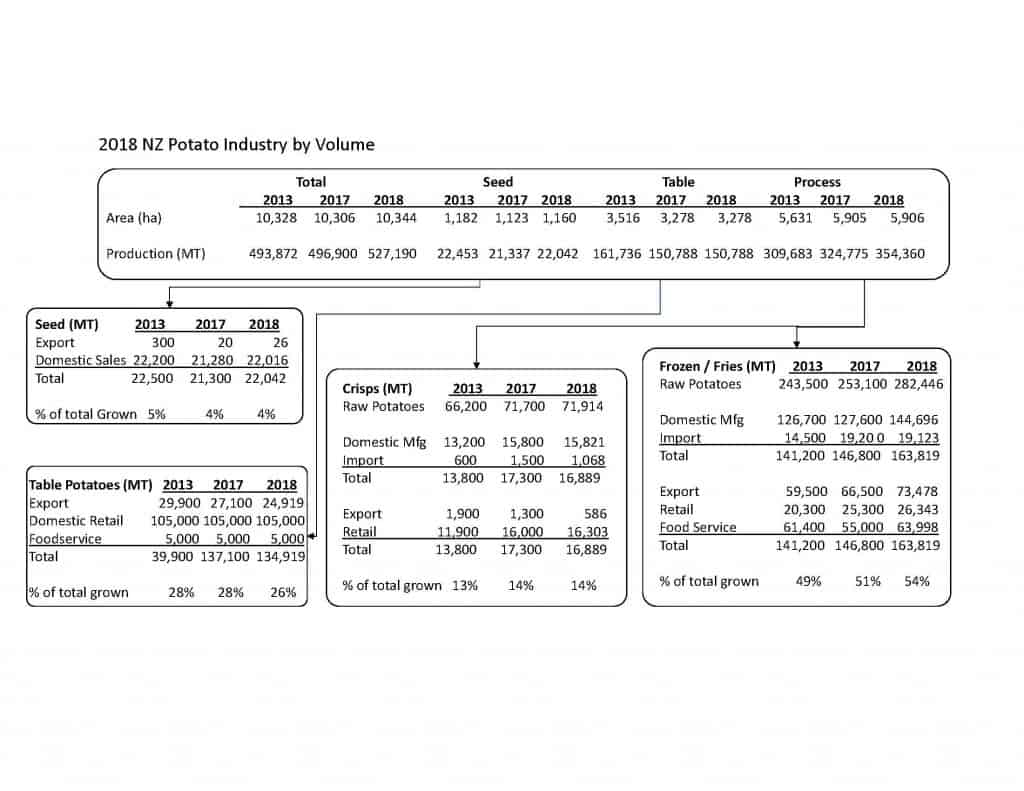

- Volumes are up because yields have improved – yield has improved across the industry

- Volume has risen as well as value

- Most volume has gone off-shore and into NZ food service market

- Are people eating more chips in NZ? The values chart indicates yes. Domestic processed volumes are strong

- A drop in export value for fresh/table to the Pacific Islands, while the volume remains static

- Reduction in the export of crisps – primarily due to 2017 crisping variety yields and availability

- Overall increase in process yields

- The latest biosecurity incursion didn’t appear to impact the export market

- Estimated annual growth in value is 6%

- The industry is now worth over a billion dollars/annum.

The good news is market access for frozen fries is not hindered by any phytosanitary requirements and so our export market is good, especially due to the drought in Europe. We’ve seen gain in frozen fry values but loss in table values.

“South East Asia is showing increased interest in processed potato products (frozen and crisps)”.