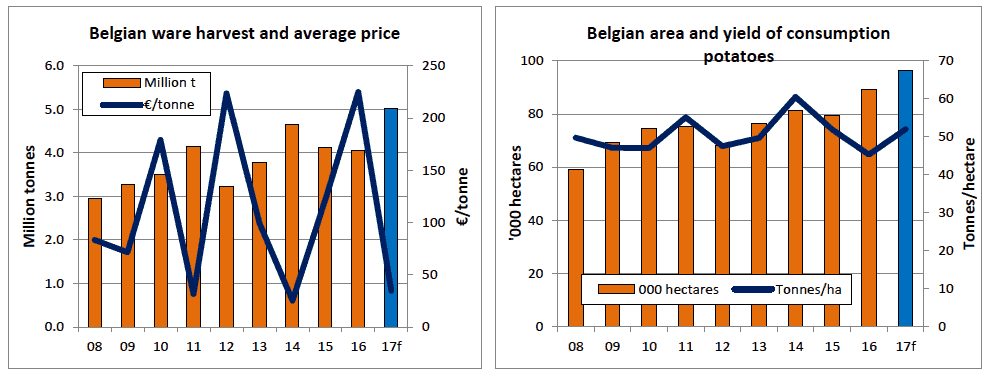

Expert opinion in Belgium is that a ware harvest of 5 million tonnes is probable this year. The planted area, according to the regional CAP declarations, is a provisional 96,280 hectares and trial liftings have shown yields of 50 tonnes/hectare for Bintje and even more for Fontane and Innovator. These yields are high but are dwarfed by the 57.1 tonnes per hectare national average achieved in 2014, again using grower association figures.

| Belgian area, yield and production of consumption potatoes, 2011 to provisional/forecast 2017 | |||||||||

| 2017pf | % change | 2016 | % change | 2015 | 2014 | 2013 | 2012 | 2011 | |

| Area (hectares) | 96,281 | +7.8 | 89,290 | +12.3 | 79,504 | 81,434 | 76,210 | 67,996 | 75,204 |

| Yield (tonnes/ha) | 52.0 | +14.8 | 45.3 | -12.7 | 51.9 | 57.1 | 49.7 | 47.5 | 55.1 |

| Harvest (million t) | 5.007 | +23.8 | 4.046 | -2.0 | 4.130 | 4.650 | 3.780 | 3.230 | 4.150 |

| Note: WPM forecasts for 2017 in italics. Sources: Centre Pilote Pomme de Terre. Fiwap; Carah; PCA/Inagro. | |||||||||

It can be seen from the charts that the impetus behind the larger harvests is area increases. Yields are cyclical and the trend over the past decade is only marginally upwards. Much more of the crop is now being contracted and a consequence is severe seasonal fluctuations in free-buy prices over the storage period. Growers of free-buy potatoes had done relatively well over the past two seasons but will make heavy losses in 2017/18.

For processors in central EU-5 countries the big crop is very good news. Internal and world demand has been growing relentlessly, despite relatively high EU fry export prices over the past two seasons of €740-770/tonne.

Contract prices are around €120-130/tonne for delivery next spring so the raw material cost for one tonne of fries would be €210-230/tonne. The manufacturing cost is around €250/tonne so the total cost should be below €500/tonne, so profitability should be good at a fry export price of €650-700/tonne.

Reproduced with permission from World Potato Markets Issue 338.