European Frozen Fry Exports to New Zealand Continue to Increase

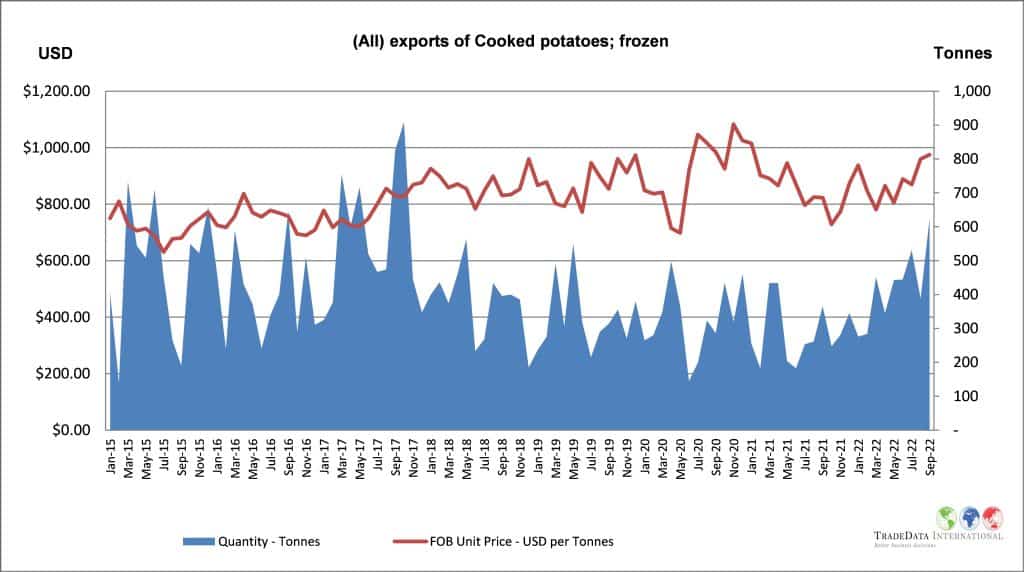

Source: World Trade Data – Exports frozen fries from Belgium and the Netherlands

Concerningly exports of frozen fries from Belgium and the Netherlands are still increasing to the quarter ending September 2022, despite a slower August, September rebounded with the highest volume since 2017. Most of this volume is from the Netherlands.

Exports of frozen fries to New Zealand from Belgium and the Netherlands

In the last quarterly report, there was concern that the export price to New Zealand observed in graph above was relatively flat at around USD $850 per tonne. Last two months show this has increased to around USD $970 per tonne but this is still below export prices from Belgium and the Netherlands to other global markets at around USD $1,030 per tonne.

Implications for the New Zealand industry?

- Loss of New Zealand market share. Last quarter it was estimated at 3 share points but with volumes still increasing it may be more. With export volumes still increasing it is looking increasingly likely.

- Again, the other factors mentioned in the last quarterly report would still be relevant:

- Possible gross margin squeeze as the price from the EU is used as leverage to drive lower prices from the NZ processors of frozen fries.

- With the disproportionate export price to NZ versus all other global markets it would seem logical that the previously alleged dumping margins from Belgium and the Netherlands to New Zealand can only have increased.

- If this issue is significant, the trade remedies legislation is still a tool the NZ industry could leverage. An anti-dumping application could be put together to prompt the New Zealand trade remedy authorities to investigate again.

New Zealand Frozen Potato Exports and Imports

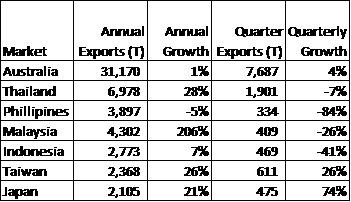

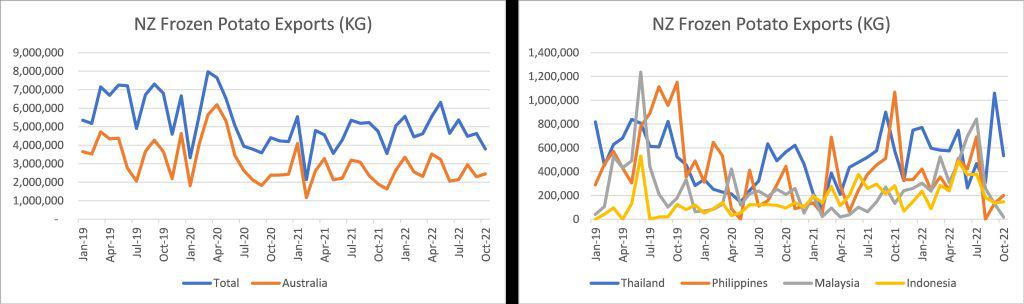

Source: New Zealand Statistics – All Frozen Potato Products

Latest quarter exports to Asian markets looks to have been a struggle with declines versus year ago for the top 4. It would appear these Asian markets are becoming increasingly contested for market share with suppliers from India, China and the EU all increasing their market share latest quarter. Note commentary is based on volume except where stated.

- Total export growth of -15% latest quarter and 8% annual growth by volume. Value growth is now ahead of volume growth at -6% on quarter and 10% annual indicates NZ frozen potato exporters are starting to pass on price increases to offset the significant input cost increases they will have experienced.

- Taiwan and Japan continue to be star performing export markets as shown in table below.

- Interesting to note exports to South Africa in both August and September. Both months had identical export volume of 108,750KG.

- Another new market is what looks like sales of a container of product to Viet Nam in September albeit at very low value NZ $768 per tonne FOB.

- It would appear there were some opportunities that presented themselves for both Hong Kong and Korea a year ago that have not repeated this year but could be an opportunity to reach out to those customers again.

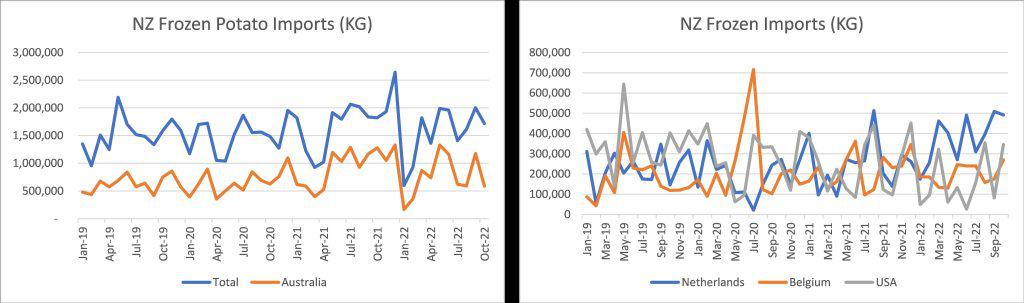

- Total imports at 19,975 tonnes last 12 months slowing with annual growth 2% but growth on the quarter in decline at -6% which continues to be driven by a large decline in imports from Australia -30% latest quarter.

- As previously discussed in the first section, imports from the Netherlands are now showing strong growth at 63% on the quarter.

- Another significant supplier the USA is also showing strong quarterly growth at 18% on the quarter and poses the question if this is an issue for the NZ industry?

Exports to all markets with annual sales greater than 2,500 tonnes.

Imports from all markets with annual imports greater than 2,000 tonnes.