New Zealand Frozen Potato Exports and Imports Quarterly Report

NZ Statistics – All Frozen Potato Products

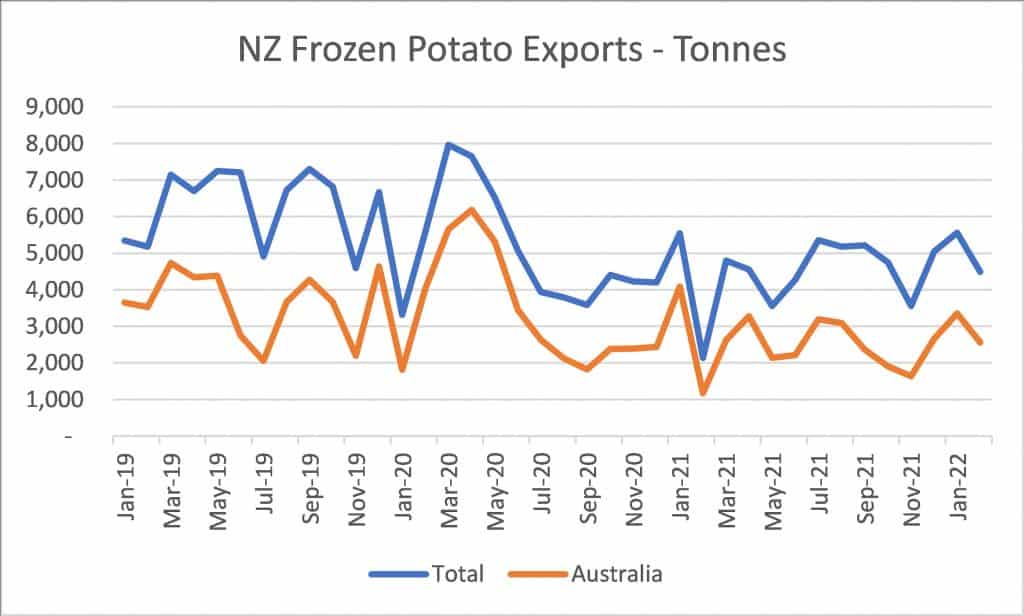

- Export growth of 27% latest quarter showing signs of recovery with annual growth at (5%)

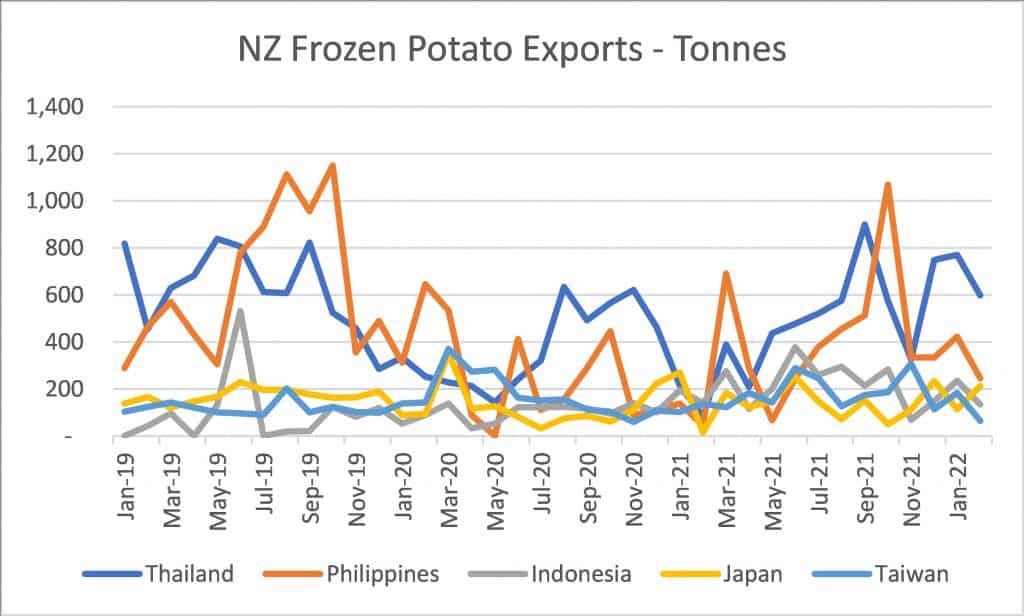

- Export growth markets include Thailand 178%, Malaysia 185% and the Philippines at 242%. These three markets contributed 2,586 tonnes of a total 3,223 tonnes growth on quarter.

- Export growth to Australia 12% and Japan 9%. Japan represents an opportunity for NZ processors with US suppliers continuing to face extreme supply chain disruption leading to shortfalls and rationing of frozen fries in Japan.

- Other key export markets for NZ are Indonesia with annual growth of 89% which has slowed to 19% latest quarter and Taiwan with modest annual growth of 6% and latest quarter 4%.

- Although a smaller export market, Korean exports have totalled 587 tonnes last 12 months a five-fold increase on year prior. Opportunity for continued future growth?

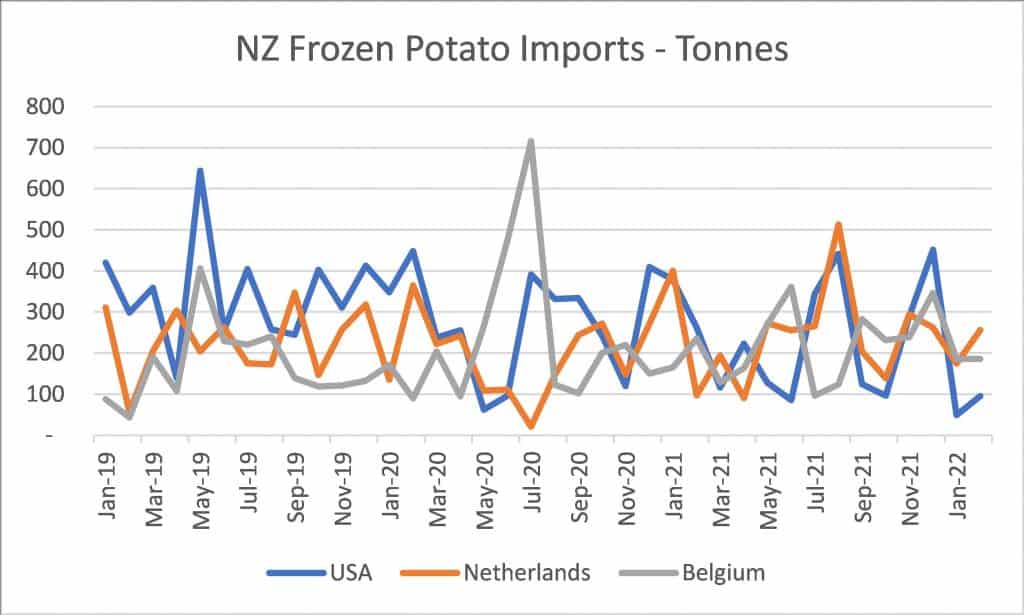

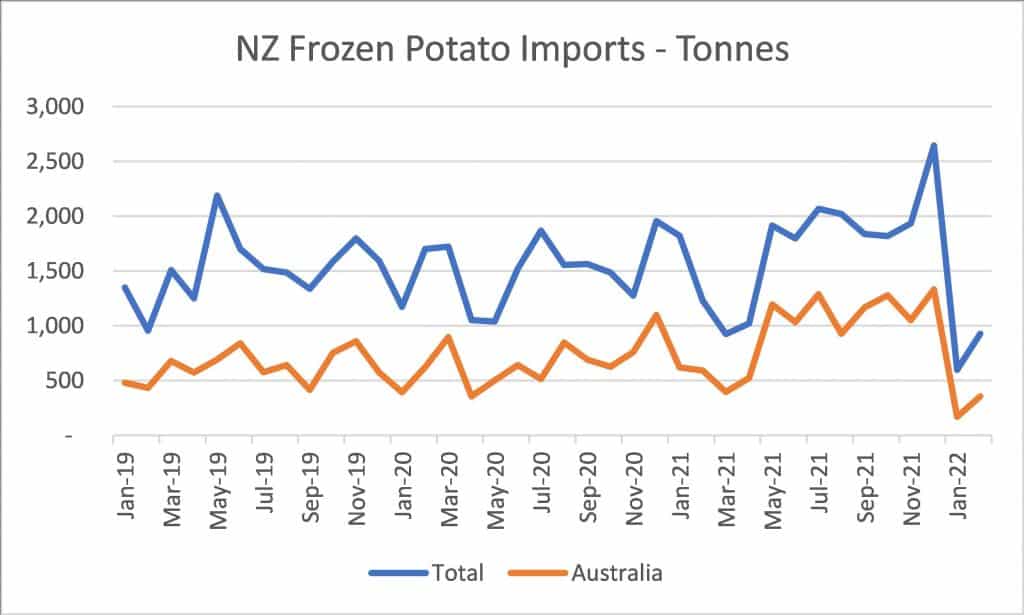

- Imports in decline on quarter at (17%) with annual growth of 8%. Decline on quarter driven by Australia (20%) and USA (43%). It would appear that supply chain disruption to Japan from the US is also being seen in imports from the US to NZ.

- Belgium and the Netherlands 6% net growth for imports combined latest quarter. Interestingly in the world trade export data purchased for Belgium and the Netherlands exports declined (13%) so no obvious increase in threat from these two countries.

| NZ exports above and NZ imports below |

World Potato Markets Report (WPMR) & World Trade Data

WPMR commentary indicates EU industry is facing an increasingly uncertain future with:

- Ongoing uncertainty driven by global Covid pandemic

- Ukraine conflict changing the global market dynamic for certain key commodities required in processing of frozen fries such as sunflower oil with 50% of the worlds exports of sunflower oil coming from Ukraine

- Combined effects of the pandemic and Ukraine conflict driving inflation across other key inputs

- EU potato growers looking to reduce area of potatoes grown in favour of other higher priced commodities.

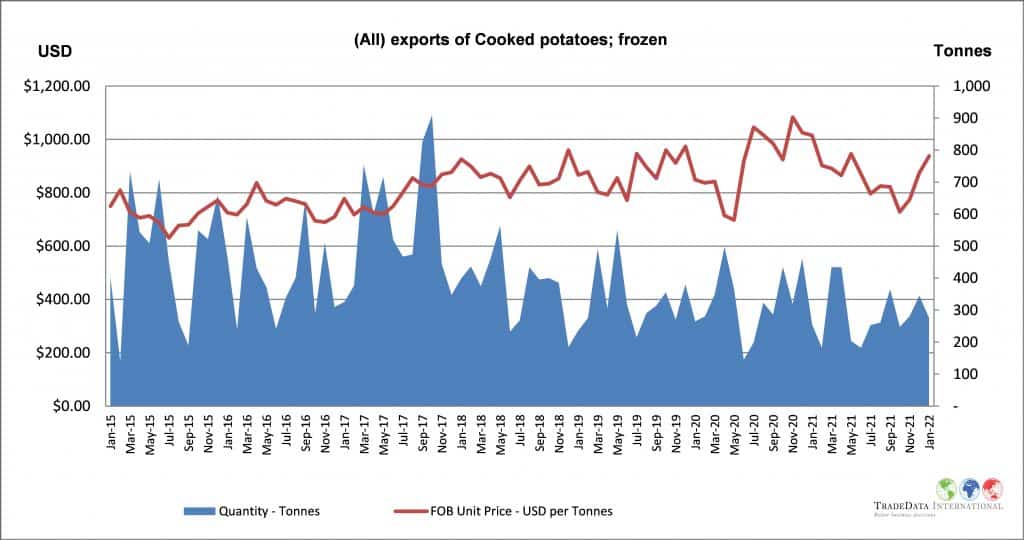

As previously mentioned, exports to NZ from Belgium and the Netherlands for frozen fries have declined (13%) by volume latest quarter for world trade export data. What is promising is that the export price is increasing back to historic levels. See graph below.

Exports to Australia from Belgium and the Netherlands appear to have steadied with decline on quarter (5%) but still a lot higher than prior mid-2020.

Of note is the increase in imports to Australia from Argentina in January at 821 tonnes. Argentina frozen fries were starting to appear in New Zealand but there have been no further imports this year. An emerging exporting nation to keep a close eye on given their growth in numerous other export markets.

Of interest is that the South Africa industry and government trade authorities have initiated an anti-dumping investigation against Belgium, Germany and the Netherlands in November 2021. This is on the back of a significant increase in imports post the lapsing of anti-dumping duties.

Imports to NZ from Germany are minimal but over the past year there have been some imports from another EU5 nation France, 150 tonnes last 12 months.

For China, a significant recent change is the introduction of new food import regulations which has had a negative impact on volumes exported to China from the global market. On the flip side if the changes are understood and complied with well, it could represent an opportunity for NZ exporters. Exports to China from NZ past 12 months totalled 131 tonnes.