An extract from our soon to be released Annual Report.

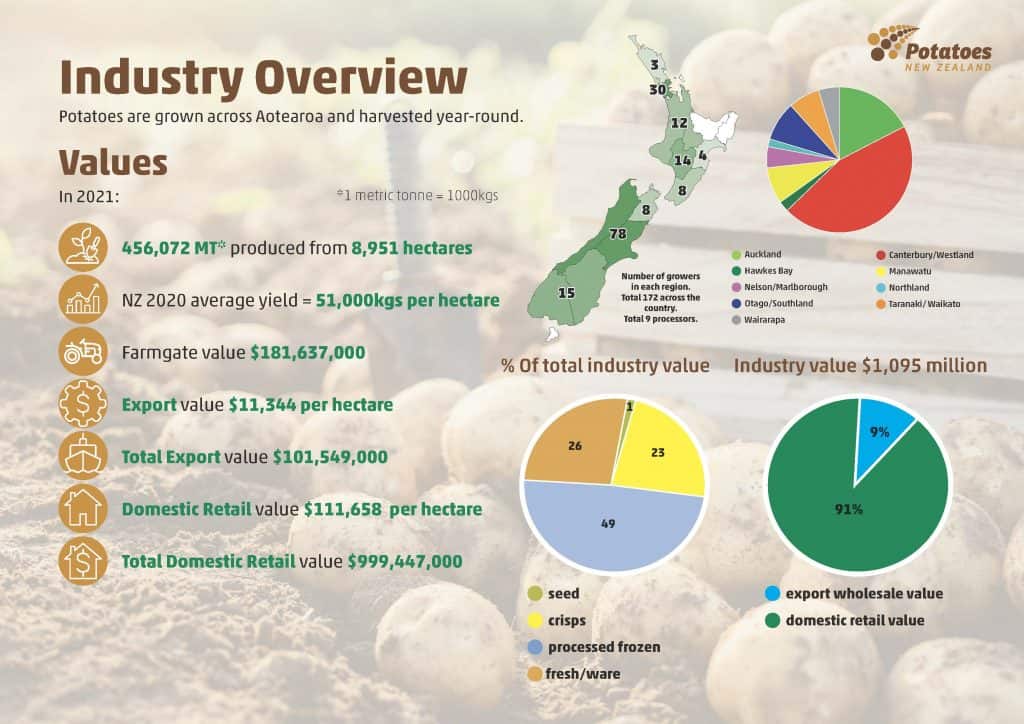

Looking back, as we do at this time of year to 2021, we saw an even tougher year than 2020 and the consequences of the pandemic really started to hit. In addition, the rising costs of compliance and production meant we saw a slight dip in overall industry value from $1.2 billion to $1.1 billion.

Potatoes New Zealand (PNZ) revised our industry goals in February 2022, after achieving 50% value growth in the domestic market, earlier than targeted in our previous Strategy & Plan.

The 2022 Strategy is:

1. Double the value of fresh and processed New Zealand based exports by 2025

2. Net Zero nutrient and GHG emissions from the potato industry by 2035

These targets, agreed by the board, maintain industry’s economic, social and environmental pillars.

Our industry reached an overall value of $1,094,966 in 2021 and achieved overall value growth of 41% since 2013. The data shows that 72% of our NZ crop is processed (frozen and crisps) and this is the reason our industry value has held steady. Noticeably there was a doubling in value for the crisping sector. Comfort food was popular during the pandemic!

We saw a 10% increase in volume exported but a nominal increase in value for fresh/table to the Pacific Islands.

The export market peaked in 2017, but the continued impacts of the pandemic, resulted in a 20% drop in our exports from that peak, until the end of December 2021.

Growers maintained farmgate value at $181,637,000 but we observed a volume and value drop, across both export and domestic markets.

The key takeaway from 2021 is that a strong domestic market underpins our industry. It affirms that securing and stabilizing our domestic market share should remain a top priority for PNZ. A strong domestic market maintains NZ industry resilience.

More details on the 2021 industry values and volumes performance can be seen here.

PNZ spent $1.9 million on R&D in 2021. As a commodity levy group, it is imperative that we control our own checkbook and we seek additional funds in order to leverage the value of our levy.

The PNZ RD&E strategy comprises sustainability, optimizing nutrients, pest/disease management, potato breeding, on-farm productivity and manufacturing innovations. The specific objectives for 2021 activities were to provide growers with the tools to deal with existing pests and diseases, ensure they were protected from biosecurity incursions, as well as helping growers develop infrastructure and methods to improve water and nitrogen use efficiency.

PNZ projects were reported on regularly in NZ Grower, PNZ newsletters, websites, technical bulletins, R&D programme events and at regional visits/meetings.

PNZ seek to maintain and grow our markets and one of the ways we do this is through ‘industry good stories’, undertaking promotions and marketing initiatives.

Media communications remained steady in 2021 with around 10,000 followers across 5 channels and we spoke to 2,500 subscribers to our monthly newsletter and email-notices. We continued to benefit from the promotions run by our strategic partners at United Fresh.

Our team continued their good work in quality, covering the three essential industry functions of maintaining compliance, biosecurity, and standards. We gained inhouse capability in 2021, with the addition of father-son duo, Cyril and Tristan Hickman, as seed quality team members.

Our small team, ably supported by the PNZ board has come through another pressure-cooker year for industry.

This year we farewell Bharat Bhana and Mike Moleta from our board, with much appreciation for their time in governance.

Looking forward, we remain focused on research programmes and extension to address growers’ challenges.

2021 Key Achievements

- Biosecurity Readiness & Response – PMTV pest management annual review.

- Biosecurity Readiness & Response – routine monitoring for sector risk organisms.

- Quality Assurance – NZ Seed Potato Certification Rulebook & Seed-lines revised and published.

- Quality Assurance – employed 2 new team members to our inhouse NZSPCA inspection team.

- Quality Assurance – Residue Compliance Information for Potatoes New Zealand revised and published.

- Communication – 3X weekly social media PR promoting sustainably grown NZ potatoes and potato products, across 5 channels with 10,000 followers.

- Communication – 4 new videos on pest/disease, innovation and RD&E added to our YouTube channel.

- Communication – averaging 40 ‘positive news about potatoes’ articles in national and global media each month.

- Communication – 10 PNZ events/industry meetings held during 2021-2022 despite pandemic disruption, reaching 174 attendees.

- Communication – successful pivot to regional industry forum, when PNZ 2021 conference was cancelled due to Covid-19 lockdown.

- Communication – teamed up with EatNZ for Feast Matariki celebrations.

- Communication – our strategic partners United Fresh ran 2 campaigns for us, Spring & Christmas, with a combined reach of over 3 million social media users.

- Research, Development & Extension – 28 R&D projects completed since 2013.

- Research, Development & Extension – 4 multi-project programmes and the ongoing Ag-Chem Strategy continuing without disruption.

- Research, Development & Extension – $4.7 million Sustainable Vegetable Systems project meeting 2nd year milestones.

- Research, Development & Extension – assisted the processing sector’s Canterbury Potato Liberibacter Initiative.

- Research, Development & Extension – signed a memorandum of understanding to investigate the establishment of The Lincoln University, Potatoes NZ, Centre of Excellence in Potato Research and Extension.

- Grower Representation – representation on GIA Deed Governance Group, Plant Market Access Council (PMAC), Sustainable Vegetable Systems Governance and the Trust Alliance Inc Board.

- Administration – Strategic Plan and Business Transformation Plan updated and communicated to growers and stakeholders.

- Administration – membership database active and continuing to increase levy value as a result.